The State of Investment in Deep Tech with Leslie Jump and Mack Kolarich from Different

Hi! Ben, Partner @ SOSV here- the early stage deep tech fund focused on hardware and biology, via our programs HAX and IndieBio.

One more week of Covid-19 around the world … at least it seems to be losing ground! This pandemic is also a reminder that deep tech is needed more than ever.

This episode of our podcast Deep Tech: From Lab to Market (@LabToMarket) features the authors of a remarkable DeepTech Investing Report.

It is based on more than 150 interviews with VCs, LPs and other stakeholders.

It is authored by Leslie Jump (CEO), and Mack Kolarich (CPO) of Different, an organization that helps institutions and family offices discover, analyze, diligence, and select venture capital funds.

Prior to Different, Leslie and Mack had diverse experiences including founding and investing in tech companies, and running investment workshops around the world.

The report was funded by Schmidt Futures, a philanthropic vehicle created by former Google & Alphabet Chairman Eric Schmidt and his wife Wendy to “advance society through technology, inspire breakthroughs in scientific knowledge, and promote shared prosperity”.

Note: We will be hosting a (free) online seminar on ‘Deep Tech Startups Against Covid-19’ on May 28 (9am-10 PST) featuring investors who funded multiple startups for the prevention / testing or treatment of the pandemic. You can RSVP at bit.ly/startups-vs-covid.

Leslie Jump is the CEO and Mack Kolarich the CPO of Different, an organization that helps institutions and family offices discover, analyze, diligence, and select venture capital funds.

They recently completed a remarkable DeepTech Investing Report based on more than 150 interviews with VCs, LPs and other stakeholders.

The report was funded by Schmidt Futures, a philanthropic vehicle created by former Google & Alphabet Chairman Eric Schmidt and his wife Wendy to “advance society through technology, inspire breakthroughs in scientific knowledge, and promote shared prosperity”.

Prior to Different, Leslie and Mack had diverse experiences including founding and investing in tech companies, and running investment workshops around the world.

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences).

Episode Overview

In a recent podcast with Joe Rogan, Elon Musk said:

“There’s an over-allocation of talent in finance and law. We should have fewer people doing law and fewer people doing finance, and more people making stuff. […] If you don’t make stuff, there’s no stuff.”

This rings especially true in deep tech.

In this episode, we discuss:

How scientific entrepreneurs are under-capitalized relative to the market and relative to their own potential.

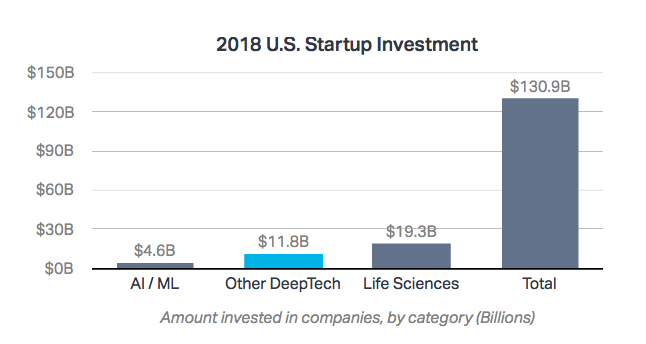

Note: all charts are extracted from the DeepTech Investing Report

What are the causes of this capital gap.

The importance of government and SBIR grants in deep tech.

How media and others have trained VCs and LPs to look for, and expect unicorns, outliers and outsized multiples.

The optics problem of science vs. software startups with LPs and banks.

How most deep tech funds partners don’t have PhDs, but rather prior founding or operating experience in deep tech, and rely on networks on experts for technical due diligence.

How — since when asked about a startup potential, 3 PhDs will give you 3 different answers — the job of investors is to figure out which one to believe.

How talent is spread out geographically more than we might expect, and how deep tech startups do not only come from universities.

The challenge of training or complementing scientists with business and storytellingskills, particularly in ecosystems without a critical mass of business talent.

How LPs suffer from network bias when picking VC funds, and why only a minority is able to vest new deep tech funds, thinking ‘I don’t know how to know if they know what they’re doing’.

Why, within the ‘alternative assets’ class, deep tech funds combine the highest risk, highest fees, longest terms, but also how delivering superior returns require newapproaches, and how Covid-19 demonstrates that weneed deep tech more than ever.

How deep tech startups differ from FMCG or SaaS companies, and why investors might have to custom-design KPIs for each company.

How lookingoutside of tech helps think differently about tech.

References Mentioned

Different and their DeepTech Investing Report

Abstract: The Art of Design (Netflix)

The World’s Most Extraordinary Homes (Netflix)

Pepper: A History of the World’s Most Influential Spice (book)

The Mote in God’s Eye (sci-fi book)

Ubongo: a leading edutainment company based in Tanzania.

Subscribe

Podcast: Apple Podcast, Google Podcast, Spotify, etc.

Twitter: @LabToMarket

Previous Episodes

06/ Sota Nagano, Partner at Abies Ventures

Abies Ventures is a $40m deep tech fund based in Japan backed by Taizo Son.

Sota talks about Japan’s deep tech scene and rising sectors.

05/ Seth Bannon, Founding Partner of Fifty Years

Fifty Years is a $50m early stage fund investing in science startups solving the world’s biggest problems.

Seth explains about how science startups build the future.

04/ Kelly Chen, Partner at DCVC

DCVC is $725m deep tech fund active in agtech, space, industry and biology.

Kelly shares her views on investing in Old School Industries.

03/ Manish Singhal, Managing Partner of pi Ventures

pi Ventures is a $30m deep tech fund focused on India.

Manish talks about India’s deep tech landscape.

02/ John Ho, Partner at Anzu Partners

Anzu Partners is a US-based $190m fund investing nationwide.

John talks about investing in Breakthrough Industrial Technologies

01/ Matt Clifford, Cofounder of Entrepreneur First (EF)

EF is a $115m fund investing in deep tech pre-team and pre-product.

Matt explains how they apply the lean startup to team formation.

You’re much welcome to send us your comments, subscribe and share!

MORE RESOURCES

Here are some articles you might be interested in:

Deep Tech Investors Mapping by Hello Tomorrow

A great interview of Josh Wolfe, co-founder of Lux Capital, by Polina Marinova (@polina_marinova, ex-Fortune) for The Hustle.

A creative Twitter thread by a time-traveler from 2025 on the post-Covid world.

SOSV portfolio companies fighting the pandemic, our call for biotech startups and hardware investment outlook.

Deep Tech Trends Report and Hardware Trends Reports by SOSV.

Until next time!

—Ben

Benjamin Joffe

Twitter | LinkedIn | ben@sosv.com